Green Dot today launches the smartphone-based GoBank, which will have no overdraft or penalty fees, no minimum balance and a “pay what you feel is right†monthly membership fee.

Let’s take a step back to set this up. Lots of startup types go about their lives in search of something they can fix. “Banking!†they think. “Banking sucks! I hate all the fees and unfriendliness.â€

Let’s take a step back to set this up. Lots of startup types go about their lives in search of something they can fix. “Banking!†they think. “Banking sucks! I hate all the fees and unfriendliness.â€

But then they realize that banking is really hard. To do it right, you have to actually officially be a bank, which takes years, even if you can find an existing bank to buy. So startups like WePay and BankSimple (now Simple, if that tells you anything) have historically partnered with banks and offered user interfaces layered on top.

GoBank promises that it can fully bridge the two worlds. That’s because prepaid card provider Green Dot actually bought an FDIC-insured bank in Utah back in 2011, after two years of regulatory hurdles.

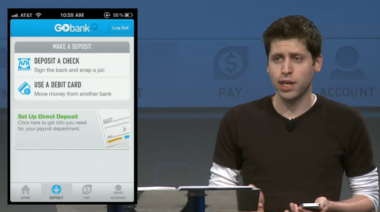

Then, in March, Green Dot bought Loopt, an early mobile location app maker that never had a ton of usage. But Loopt had a team of mobile developers and a strong leader in Sam Altman, one of the earliest participants in Y Combinator and a significant influence on the famous startup program as a part-time partner.

Altman said in an interview yesterday that he’s seen many a startup apply to YC over the years, trying to be a bank. But none of them were equipped to do it. “This is a product I’ve always wanted to build,†he said, “and it was just starting up when we were talking to Green Dot.â€

Altman said it should take approximately four minutes to set up a GoBank account, and it can be done from a mobile phone. Starting today, GoBank plans to let 10,000 U.S. users in for a beta test, and expand from there.

GoBank charges for just four things: Putting a personal photo on your debit card ($ 9), going to an out-of-network ATM ($ 2.50), spending money in another country (3 percent), and paying your membership fee (whatever you want, a la Radiohead or Humble Bundle).

But it promises that it has a huge network of fee-free ATMs â€" 40,000, more than twice as many as Chase and Bank of America.

But it promises that it has a huge network of fee-free ATMs â€" 40,000, more than twice as many as Chase and Bank of America.

The iPhone and Android apps also include budget tools (including a silly “fortune teller†feature that makes judgment calls on new purchases), an option to see your balance without logging in, bill payments and ways to send money to people outside the network through PayPal. Savings accounts and mobile alerts are also included.

The idea of allowing people to pay whatever they want for banking is an odd one. It might make sense in the context of thinking about the human appreciation you have for an artist like Radiohead, but this is a bank we’re talking about. Users can pay anywhere from $ 0 to $ 9 per month.

Altman said he likes the challenge. “We’re accountable to deliver a service that users think is worth something.â€

No comments:

Post a Comment