Good news, remaining Time Inc. employees! You don’t have to go work for a company based in Des Moines*.

Good news, remaining Time Inc. employees! You don’t have to go work for a company based in Des Moines*.

As far as the bad news… we’ll get to that. But let’s stay upbeat for a minute, and I’ll try to generate some more optimism for you.

Start with some charts, via Google Finance.

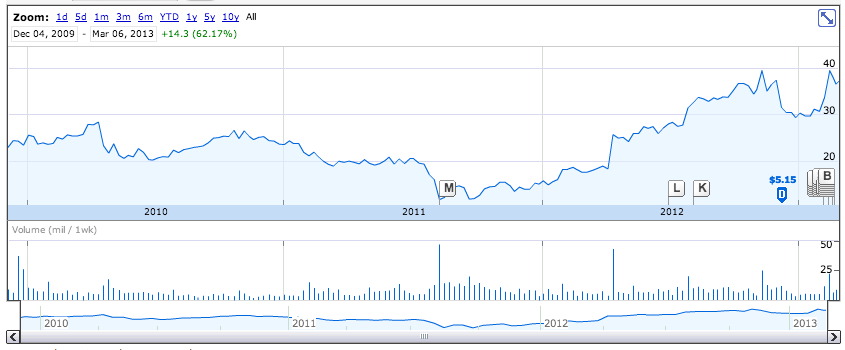

Here’s what happened to AOL stock after the company split off from Time Warner, just like you’re set to do:

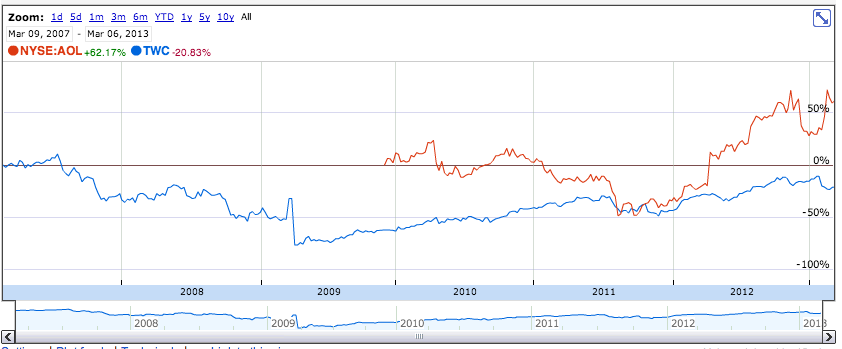

And here’s what happened to Time Warner Cable shares when that company did the same thing:

And for good measure let’s mash them together:

So, on the whole, not too terrible. Two companies that Jeff Bewkes didn’t want weighing down his cable and movie business, and they’ve done OK once he cut them loose. AOL shares are up 62 percent since the split**. Time Warner Cable is down 21 percent, but shareholders have gotten another $ 6.41 per share in dividends, so things are a bit better than they look here.

Let’s continue to stay upbeat, and channel the talking points you’re likely to hear in months leading up to the split:

- Hey, just because this is Plan B for Jeff Bewkes doesn’t mean he doesn’t want this to succeed. Time Warner, after all, will end up owning a chunk of the spun-off company, so it has a vested interest in this thing working.

- And seriously, this could be good for Time Inc! After all, in the last few years the thing has just been in stasis/shrinking mode, and no one cared. Now they’ll have to care, and maybe the newco will go do some serious re-orging and perhaps some investing, too. After all, it’s good enough for News Corp!

And all of that is potentially true. Or at least truthy. Or something.

Alas:

- Jeff Bewkes doesn’t care about Time Inc and investors don’t either â€" they’ve wanted him to dump it forever. If they haven’t priced the spin-off into the share price already, they will do so immediately, and then that will be that.

- It’s hard to imagine any scenario where Time Inc. is able to navigate the print-to-digital shift effectively. But it certainly won’t get its best odds as a public company made to answer to the Street’s quarterly demands. And even if, say, a deep-pocketed and semi-benevolent benefactor materialized to buy the thing, Bewkes wouldn’t sell, because of the tax hit that would generate (the spin-off will be tax free for shareholders).

- For better and worse, the News Corp. spin (which is set to include this Web site) is going to be steered by Rupert Murdoch, a man with lot of money invested in the company’s perfomance, and even more ego tied up in it. Time Inc. will be run by… someone, and they’ll get a nice paycheck and some options for their effort, but no one expects them to work a miracle here.

- And that’s what Time Inc. stripped of Time Warner’s corporate shield, will need to turn around. It has the classic analog/digital channel conflict, where the latter is the only way out, but the former generates all the cash. And that’s hard enough to deal with at the most nimble and most flexible companies. This one, shoved out of the nest and into the market without any kind of cushion, seems set up to fail. I hope I’m wrong.

*Des Moines is nice enough, by the way. But the Meredith/Time Inc. culture clash stories you heard were very true.

** True, AOL has fired a lot of people since it went its own way. But that’s going to happen at Time Inc. no matter what. And yes, the stock’s rise has a lot to do with a $ 1 billion patent sale, but let’s stay positive!

[Shutterstock/mikeledray]

No comments:

Post a Comment